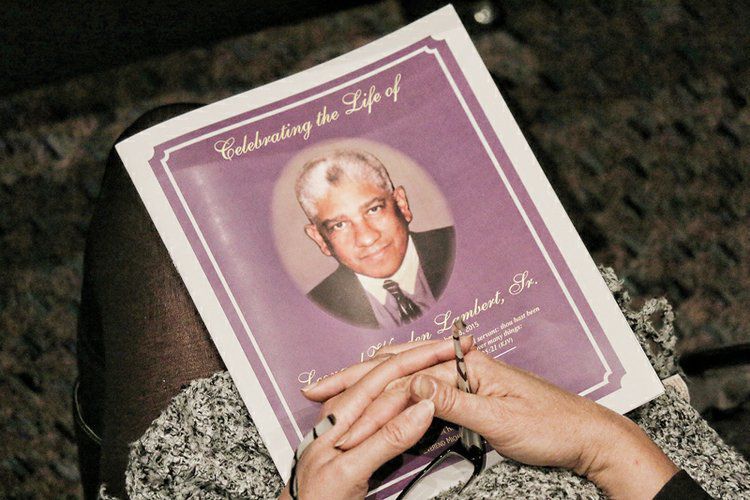

4 Tips for Preparing for your Funeral

Death and funerals, while unpleasant for many of us to consider, are inevitable occurances that we need to prepare for, both emotionally and financially. As one gets older, the burden of care falls on younger, and often less financially stable, family members. This reality makes it all the more important that the elders within a family provide clear and practical next steps upon their death. No one wants their family’s grief and sadness to be compounded with financial stress.

There are a number of ways for individuals to set aside money for their funeral services. Here are some tips and strategies.

1. Be Realistic

Coming face-to-face with funeral costs can be jarring for some. The products, services and planning that go into creating a beautiful celebration of life can be expensive—there is no way around this. So it’s important to always remain aware of your personal financial standing and that of your family. It is possible to plan a beautiful memorial service without spending a fortune, it just requires some advanced planning and good advice from a trustworthy funeral director.

2. Set a Budget

One way to be realistic is by setting a firm budget for yourself. Decide how much money you can afford to spend on your final celebration without burdening your fmaily with too many extra costs. Once you have set this number, it will allow you to be more decisive in your choices and realize what plans or dreams might have been a little beyond your financial means.

3. Shop Around

Some people have an attachment to a particular funeral home, which often has long-term significance within the family. If you are unattached to a particular home, and live in a reasonably-sized city or town, you likely have several choices of where to host your funeral service. Take your time, meet with a few homes and funeral directors, and choose the one that works best for you and your budget. Remember that this is the company that your family will be working with after your death, so it might be reasonable to let them have some input, as well.

4. Set Aside the Money

Setting aside money for a funeral can take many forms. You can literally place the money into the hands of the person who will be planning your funeral, but this is usually ill-advised—you have no control over what that money is used for, beyond expressing your wishes to the funeral planner. Irrevocable Funeral Trusts (IFTs) are another option, which we discussed in our last blog post.

Many people choose to prepay for their funeral with a specific home. This not only ensures that your ceremony goes exactly as you intended, but it also locks in the prices at a current rate and prevents you from paying more because of inflation. The downsides to this strategy are that your chosen home might go out of business or you might move to a new area, which would require reassessment of this financial agreement. That said, prepayment is one of the most popular strategies for financially preparing for a funeral.

A third way to set aside money for a funeral is with earmarked funds ina life insurance policy. These policies are called “permanent policies” instead of the more common “life-term policies.”

Preparation is Key

Whatever choices you make, the most important thing is that you make the choices. It’s unfair to leave all the decision making—and all the payment—to your family members. Especially if you have specific ideas about your memorialization, you need to ensure that a plan is in place before your death.